Esports & gaming help guide

White Paper | Authors: Dave Goodfellow, Oracle, IAB SEA+India Regional Board Member; David Vu, Tripadvisor; Haroon Qureshi, Mindshare Asia Pacific; Jack Cantwell, Dentsu International; Nic Jones, MediaCom; Tom Simpson, AdColony. IAB SEA+India CTV & Streaming Council.

WHAT IS THE PHENOMENON WITH GAMING?

The amount of people playing games, as well as the variety of content and ways to play demonstrate that gaming has never been more accessible than it is today. Yet, gaming can also seem daunting to those who may not consider themselves “a gamer”.

The different games, rules, genres and technologies of gaming, can carry a learning curve that seems formidable. As is often the case though, trying to understand everything can set you up for failure. Whereas finding and understanding the key components that may be relevant to your business can open up a variety of opportunities.

This handbook is designed to help marketers and media owners better understand the dynamics of gaming, as well as paths to consider when looking to engage as a brand or product within the space. And to do that, we’ll be focusing four key aspect of gaming:

The Players

Hardware & Software

Esports

Streaming

Everything in gaming is designed with the Players in mind - so let’s start there.

A lot of people play games. And they do it a lot.

Data from GlobalWebIndex shows that Southeast Asia (SEA) is one of the largest and most active gaming markets in the world. 86% of internet users in SEA (approximately 584 million people) play games on a mobile device, while 46% have an active interest in gaming or play on PC or console.

While there are a variety of different types of gaming devices, players in SEA prefer smartphones by a wide margin.

Gaming has an immense local reach, primarily driven by mobile. Research from Limelight Networks also highlights that time spent gaming and engagement is also high.

As of January 2020, 69.1% of gamers (meaning anybody who plays a game at least once per week) spend 2 hours or more per week playing. 31.9% play an hour or more per day, while 7.4% play 20 hours or more each week.

A common trope that has persisted around gaming is that it is heavily skewed toward younger audiences too. And that is just not true anymore. While some variation may exist in different individual games, overall 36 to 45 year old games only clock around 20 minutes less time gaming (7.09 hours) on average per week, compared to their younger 18 to 25 year old counterparts (7.48 hours).

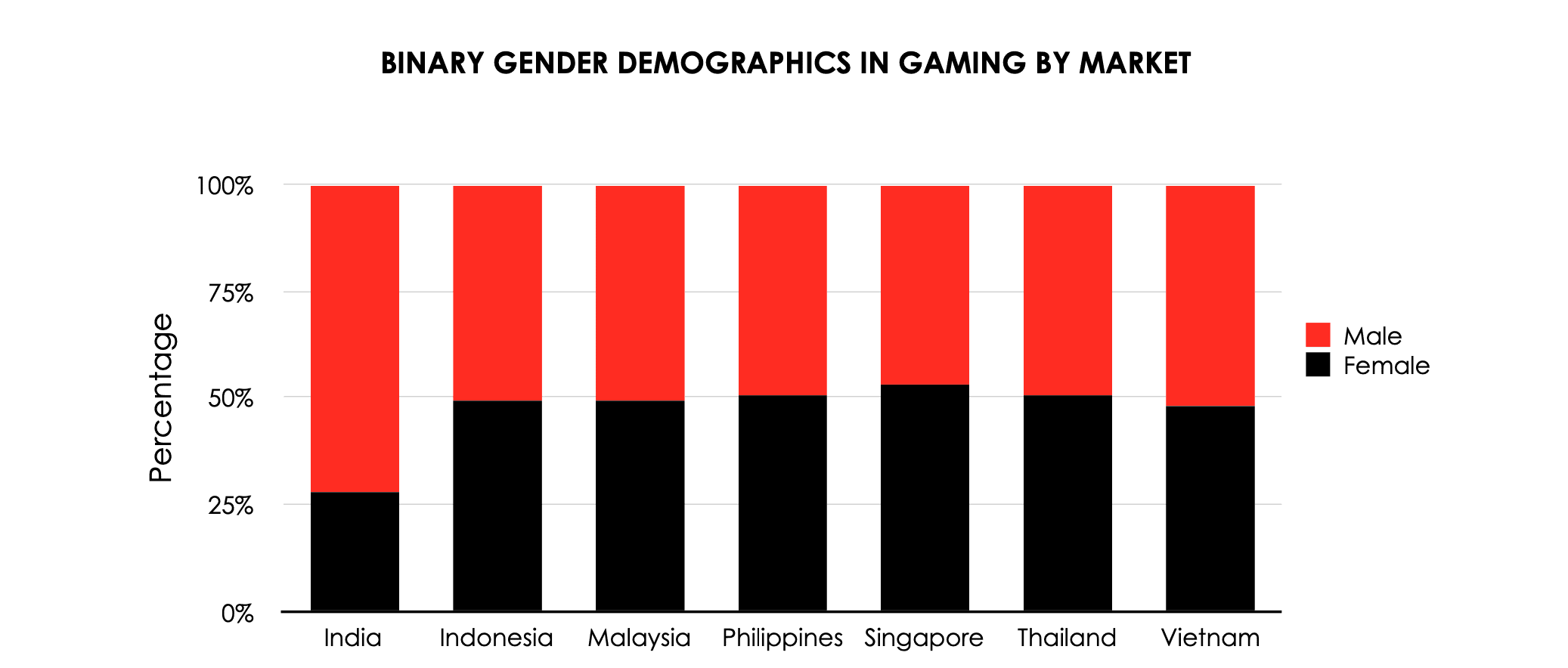

Similarly, gender demographics tell us that the male and female skew, hover around 50-50 for most markets in SEA.

Source: GlobalWebIndex

With the total reach of the gaming audience in Asia Pacific (APAC) sitting at 1.1 billion people, it is also no surprise that this audience represents a rich set of demographics and interests, including:

Player Demographics

Primary age group is 25 to 44 years old, and an average age of 32

60% mobile gamers have a college degree or certificate

50% mobile gamers have at least one child

77% fall under mid-top income segments

Player Interests

Popular Culture & Leisure: 64.0%

Science, Tech & Nature: 60.1%

Health, Fitness & Beauty: 55.0%

Home & Lifestyle: 53.0%

Current Affairs: 52.5%

While this depiction of the player shows a diverse, highly active and engaged audience within gaming, all of the behaviours mentioned so far reflect the player persona as of January 2020. And media consumption behaviours have changed significantly since then as a result of the COVID-19 pandemic.

Gaming has seen some of the largest increases in activity of any media. Unity, a Game Development Platform on which many mobile, PC and console games are built, published an insightful report in May 2020 showing precisely how gaming behaviours had changed between January and June of 2020 - key months before and after COVID-19 was declared a pandemic.

Between January and May 2020, Unity observed Daily Active Users (DAU) in mobile gaming increase 17% globally, while DAUs on Console increased a staggering 46%. Data from AdColony further enforces this activity locally, showing that 72% of people in SEA added new games on their smartphone since COVID-19 started and there has been a 46% increase in people playing mobile games multiple times per day.

Time spent gaming also increased significantly from March 2020. One of the main behavioural shifts driving this has been increased playtime on weekdays. As a likely result of people spending more time at home, between January and May the difference in daily time spent gaming on weekends versus weekdays narrowed by 63% - making gaming more of an everyday activity than a weekend leisure activity.

From the data and discussion above, gamers can be clearly seen as a highly desirable group of audiences for marketers and media owners today. To facilitate better engagement between the media industry and the gaming audience, it is crucial for increased collaboration between marketers and the hardware, platforms and software that enable gaming - which is what we’ll be talking about in the next section.

HARDWARE & SOFTWARE

As with other parts of the media industry, hardware and software play a fundamental role in defining the media experience for gaming.

While some of the key players (pun intended) in gaming media also participate in non-gaming media environments, many key hardware and software providers are entirely unique to gaming. In the following section we will provide an overview of these companies, as well as the dynamics around their contributions to the media experience.

HARDWARE

Hardware may be one of the most familiar and recognizable aspects of gaming. Partly from decades of thriving consumer electronics activity from companies like Nintendo and Sony, but also because in recent years much of gaming has shifted towards the everyday mobile devices used by many.

At present, there are three main types of hardware environments in gaming that play important roles in defining the media and player experience. They are:

Mobile gaming: Device environments where a game is delivered via a portable device. This includes smartphones, tablets and dedicated mobile gaming devices such as Nintendo’s 3DS system.

Console gaming: Device environments where a game is delivered via dedicated gaming hardware (such as PlayStation and Xbox), primarily played on TV or other non-portable screens.

PC gaming: Device environments where a game is delivered via a desktop or laptop computer.

2020 has also seen the emergence of “cloud gaming”, with the launch of Google’s Stadia and Microsoft’s xCloud. Services like these, allow games to be played on any device, by shifting the processing required to play a game to cloud based servers rather than a user’s physical device. This creates a streaming-style model for gaming, where the content becomes available On-Demand and can be consumed from a variety of different devices, similar to On-Demand video. Cloud gaming is provided through subscription models, though availability and adoption is still in early stages so we have chosen to not reference it extensively here. We will be keeping a close eye on it though, and may draw on it further in future content .

It should also be noted that it may be possible to classify Virtual Reality (VR) hardware within its own category. However, as VR is currently delivered primary in conjunction with Console, PC and Mobile hardware, we have chosen to not break it out in this discussion.

Mobile Gaming

Globally, mobile phones are the primary device used for gaming. Locally, this behavioural trend is even more pronounced.

86% of internet users in SEA play games on a mobile device, according to GlobalWebIndex. The share of this activity that is taking place on iPhone and Android devices varies significantly market to market.

In Singapore, Thailand and Vietnam, Apple has the largest individual device brand market share with over a third of the market in Singapore and Vietnam, and over a quarter in Thailand. In all other Southeast Asian markets, the leading device brand varies. However, across all Southeast Asian markets Android is by far the leading mobile platform (and by extension mobile gaming platform) based on combined device market share from Huawei, Mobicell, Oppo, Samsung and Xiaomi the multiple manufacturers that utilize the Android operating system.

Source: Statcounter, August 2020

In total, the Southeast Asian mobile gaming market was worth $3.1 billion in 2019, representing over 70% of the entire local games market.

Console Gaming

Console gaming is where many of the household names in gaming originate - including Nintendo, Playstation and Xbox, as well as the many games and characters that have been built by these companies.

Looking at urban populations in SEA, game consoles players do not lag far behind mobile. According to gaming analytics firm Newzoo, 64% of women in urban SEA and 75% of men play games on consoles. While the same may not be true for the population outside urban areas, these figures (as well as those previously shared for mobile) show that many people are playing games across multiple devices, including consoles.

2020 is also the launch year for a new generation of console hardware, something that happens once roughly every 5 to 10 years. New generations of gaming consoles, such as the Playstation 5 and Xbox Series X/S due to be launched in November 2020, primarily offer technology upgrades from previous generations that enable more immersive gameplay. As with smartphones though, when a new generation of devices is announced the previous generation becomes more accessible through at a lower price point. Both these changes can be expected to drive increased adoption of gaming console hardware within the coming years.

PC Gaming

While PC gaming is responsible for many of the largest long term gaming franchises, including Riot’s League of Legends, Blizzard’s World of Warcraft and Valve’s Defenders of the Ancients 2 (DOTA 2), as well as large player bases and PC esports scene, local data and insights on this sector of the gaming industry limited beyond device preference data from GlobalWebIndex that tells us 43.9% of gamers in SEA prefer playing on PC.

At the time of publishing, current and credible data for the PC gaming audience in SEA (including demographics, behaviours, device share/footprint and PC revenues) was not able to be found or sourced. This suggests PC gaming may be an area that requires further research and exploration to be able to adequately contrast it with mobile and console gaming locally. Less available research may also suggest a lower demand from businesses and marketers for this kind of information.

SOFTWARE

Game developers and publishers (groups of game developers or game studios under a single company) are responsible for building the games that become available across the hardware and platforms mentioned earlier. A developer can be as small as a single-person team, like Toby Fox (who famously created the widely praised game “Undertale” single-handedly), or can stretch to thousands of people such as with Activision, Electronic Arts, Riot Games, Tencent Games and more.

Traditionally, gaming platforms, publishers and developers’ revenue has come directly from game sales - including physical retail and digital sales channels. Newzoo reported total revenue for the gaming industry as US$145.7 billion in 2019, with revenue set to increase by 9.3% year on year in 2020 to US$159.3 billion. By comparison, the global film industry broke US$100 billion in revenue for the first time in 2019 and global digital ad spend was US$332.84 billion the same year. In SEA, digital ad spending is expected to hit US$2.8 billion in 2020 while in 2019 total game revenues generated in the region reached $4.4 billion - though revenues specific to ad sales are not clear at the time of this writing.

In more recent years, as smartphone and cross device gaming has become more prevalent, more games have been produced under a free-to-play model - where a game is made available to potential players for free, and revenue instead comes from advertising and In-App purchases. As this model has gained traction, there has been an increase in available gaming inventory for marketers as well as new and emerging ad formats to explore (discussed further in the Opportunities for Marketer’s section).

While gaming has experienced immense growth in audience, accessibility and revenue for years, COVID has amplified many of these behaviours significantly in 2020 - many of which are likely to have lasting impacts.

The commercial aspects of gaming have also shifted, with 24% increase in in-app purchase during COVID-19, as well as ad impressions growing by 57% (and revenues by 59%) compared to 2019. Despite the volume increases, effective cost per mille (eCPM) actually fell by 3% and clickthrough rate (CTR) increased by 34% compared to 2019 as well.

Esports

Esports is a crucial part of the gaming industry, extending the player and community experience for a variety of games. The scale and dynamics of esports deserve to be discussed in their own right though, rather than only as a subset of the gaming industry.

The most visible aspects of esports (and the gaming industry) today stem from wide coverage of esports athletes, teams, championships and games across mainstream broadcast, news and other non-gaming media. The thing that tends to draw the most attention around esports in recent years are the sizes of the prize pools and viewership for the championships. Several recent examples include:

The total prize pool for the DOTA2 International 2019 was over US$33 million and peaked at 1.9 million concurrent viewers during the final.

The total prize pool for the Fortnite World Cup was US$30 million and peaked at 2.3 million concurrent viewers during the final.

Like more traditional sporting events, esports are entertainment that brings together the best players of a game to compete. And it is this high level of competitive play that draws the gaming audience in, to see the best of the best on show - primarily streamed via Twitch, YouTube Gaming or Facebook Gaming, as well as broadcast by partners such as ESPN or DisneyXD. Complementing the streaming activity, most esports events (in the pre-COVID era) also have physical events that see stadiums and arenas booked out that bring the gaming community together in real life as well - such as the League of Legends 2020 World Championship which will be held in Pudong Soccer Stadium in Shanghai.

Esports operates across a variety of competitive game genres, including shooters (PUBG, Fortnite and Valorant), real-time strategy games (Starcraft II), Multiplayer Online Battle Arenas (League of Legends, DOTA2, Arena of Valour, and Mobile Legends: Bang Bang), Fighting games (Street Fighter V, Super Smash Brothers), and Sports games (FIFA20, NBA 2K20 and Rocket League).

Esports also has many tiers of competitive play outside the larger-scale global championships. These include regional and local championships, and even university and open leagues that provide players looking to go professional. Some such leagues in SEA include:

League of Legends Pacific Championship Series

Playerunknown’s Battlegrounds (PUBG) SEA Series 2020

Collegiate Southeast Asian Games, which featured esports as a competitive event for the first time in 2019 and is being lobbied for inclusion in 2021

Youth Esports Program (YEP) which integrates esports within school sports in the Philippines

While global esports events draw immense amounts of attention from around the world, esports viewership locally is also quite significant. Approximately one in six (16%) internet users in SEA have watched an esports Tournament, according to GlobalWebIndex. Mobile games are the most watched esports locally, with PUBG Mobile accounting for 40% of the local esports viewing and Mobile Legends: Bang Bang accounting for an additional 33%.

Worldwide esports revenues hit US$957.5 million in 2019 are currently projected to grow to US$973.9 million in 2020, though the absence of live events as a results of COVID-19 means this figure is considerably less growth than was previously expected.

The majority of esports revenue (US$584.1 million or 61% of 2019 revenue) comes from sponsorships though, which is an area that many brand marketers are familiar with. For marketers looking to approach gaming for the first time, esports can provide familiar strategies and tactics to engage with the gaming audience. And to that end, we have seen many brands already jump on board - for example, Coca-Cola is the official beverage sponsor of the Overwatch League, Toyota’s Motorsports team are the Title Sponsor for the 2020 and 2021 WRC Racing Esports Seasons, and McDonalds as an early sponsor of Starcraft 2 Championships.

Streaming

(Live) Streaming is a core channel for esports. But streaming is not confined to esports content, or even gaming. The scale and variety of content that exists across streaming content represents many interests, such as cooking, music, comedy and other entertainment - and according to Twitch, content for non gaming categories has increased 4 times over the past 3 years.

For the purposes of this guide, we will focus on gaming related streaming content. However, we would encourage readers to consider exploring streaming media opportunities outside gaming too.

The scope of streaming can be defined by the channels that enable it, most of which you will likely have heard of - whether that through the media industry, or through friends and family that engage with streaming activity.

Globally and locally, the game streaming space is dominated by Twitch, YouTube Gaming and Facebook Gaming. In 2019, Tencent also started its own streaming platform, Trovo, which is currently in beta and starting to attract attention locally - though as it is in beta at the time of writing, we will not explore it further here.

Twitch is by far the largest of the streaming platforms, by several key metrics. In Q1 of 2020, Twitch logged over 1.2 billion hours watched, while nearest rival YouTube Gaming hit 389 million hours, and Facebook Gaming 190 million hours. Total unique channels on the platform followed a similar trend in Q1 2020, with Twitch at approximately 6.1 million unique channels, YouTube Gaming at approximately 860K channels and Facebook gaming at 130K.

Between February and March of 2020, viewership increased immensely on all channels as COVID-19 and lockdowns. Month on month hours watched on Twitch rose by 23% globally, 10.7% on YouTube and 3.8% on Facebook. Once again, consumption trends show up stronger locally with Twitch in APAC recording a 57% increase in the total hours watched over the first four weeks of local social distancing, compared to the previous weeks.

While live video the core focus of game streaming, streamed content has a solid lifecycle beyond the live event. In the first half of 2020, 57% urban populations that consumed gaming content in SEA watched reruns of live streams, and 57% watched pre-recorded or Video on Demand (VOD) content. This is only marginally distinct to the 59% of the urban SEA audience that watched livestreams - demonstrating that content and marketing strategies have a longer lifecycle and impact than the just the initial stream.

OPPORTUNITIES FOR MARKETERS

The spectrum of media channels and audiences within gaming provides a rich assortment of strategies and tactics that marketers can use to engage within gaming and esports.

Many of these strategies are familiar, while some of them provide dynamics that are unique to gaming and esports.

In reviewing the many opportunities available to marketers today, we have identified four primary strategies to consider and will explore each of these briefly in this section:

Advertising

Sponsorships

Content

Commerce

ADVERTISING

Gaming environments provide a variety of advertising opportunities, many of which are familiar and operate in similar ways to non gaming environments - for example, pre rolls, standard banners, rewarded videos and in-stream ads.

There are also formats unique to gaming, such as 3D display and video ads - where an ad becomes part of gameplay, rather than a popup between or around the core gameplay experience.

Below we have outlined the primary advertising opportunities available within gaming, as well as the channels through which they are available.

Advertising Opportunities by Environment/ Channel

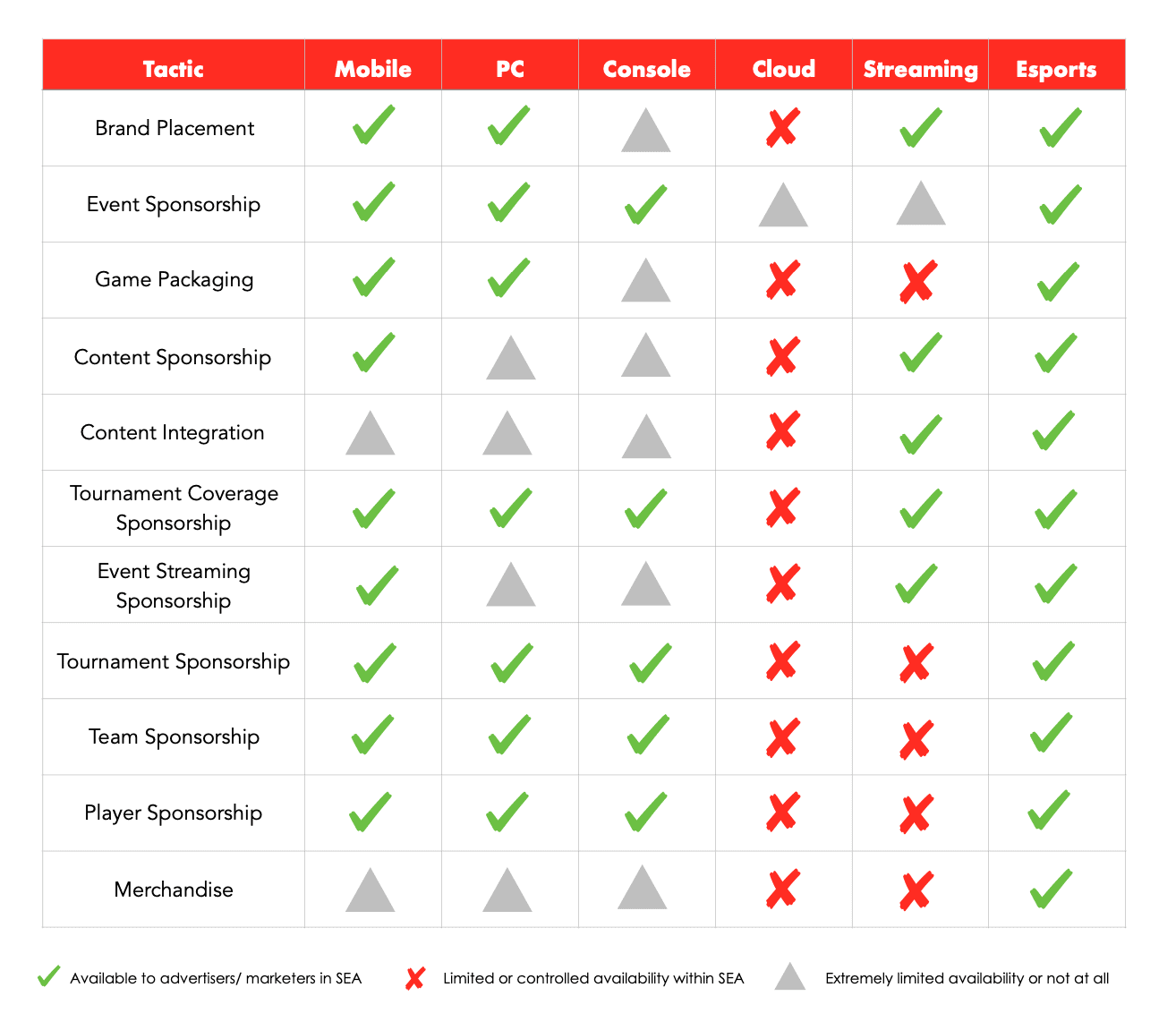

SPONSORSHIP

Sponsorship opportunities within gaming environments mimic many of their non-gaming counterparts, offering exposure and/or brand association with a property or identity for a fee.

Gaming based sponsorships are most prevalent within streaming and esports, where the availability of teams, tournaments, streamers and influencers is highest.

In limited capacities, and when the opportunity aligns with their community, game developers and publishers also provide other opportunities for sponsored content - such as in-game items or cosmetics.

Below, we have outlined the primary sponsorship opportunities available within gaming, as well as the channels through which they are available.

Sponsorship Opportunities by Environment/ Channel

CONTENT

Content marketing opportunities exist both within games, as well as around games and related activity.

In-Game content opportunities often require premium levels of investment, largely due to the work required to develop, test and manage in-game content, but also because of the size of the community and longevity of the exposure the in-game content provides.

As gaming has a significant amount of content that complements gameplay but sits outside or around actual games (such as related web content, social media, influencers, video and live event activity), there are also a variety of related content opportunities.

Below we have outlined the primary content opportunities available within gaming, as well as the channels through which they are available.

Content Opportunities by Environment/ Channel

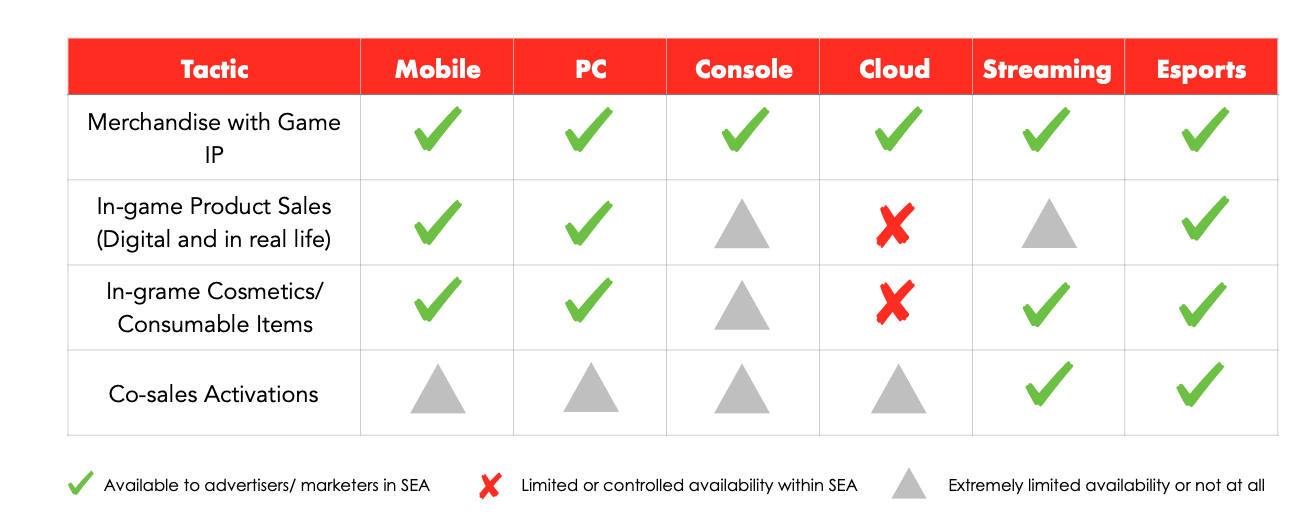

COMMERCE

Commerce based opportunities exist through in-game transactions, as well as through offline game sales and merchandising activity.

In game transactions provide some of the strongest revenue streams for game developers and publishers. They are also an opportunity for brands to collaborate around sponsored items and/ or affiliate marketing opportunities.

Offline commerce opportunities primarily leverage association with gaming brands or events to generate exposure that drives brand outcomes - such as awareness and preference.

Below we have outlined the primary content opportunities available within gaming, as well as the channels through which they are available.

Commerce Opportunities by Environment/ Channel

INVESTMENT IN GAMING VARIES FROM TYPE OF EXECUTION/ TACTIC

METRICS, RETURN ON INVESTMENT (ROI) AND MEASUREMENT

The opportunity for brands has become clearer over the last few years, and 2020 has further demonstrated the pulling power of esports and gaming for investment. Newzoo forecasts that sponsorship revenue globally year to date sits at $614 million, up 13.1% year on year – a sure sign that the growth we have witnessed thus far will continually rise.

With such continued positive growth, there are still key elements that marketers must consider before investing in esports and gaming channels. In this article we will explore some of these focus areas, and help provide a view on the questions marketers should be asking to help validate their strategy and tactics in esports and gaming activations:

Data & benchmarks

Measurement

Brand safety

DATA AND BENCHMARKS

Fundamentally the nascency of the industry has hampered the availability of data availability and reliable reporting. This is to be expected given the rapid increase in both active and passive engagement with gaming, with a huge increase in the number of areas where gaming content is consumed. There is a massive opportunity for scale and relevance, but unreliable reporting of data and benchmarks are making many potential advertisers sceptical about the true reporting of the opportunity.

A good example of this relates to the size of the mobile gaming opportunity, where marketers base investment decisions often on reported numbers from OS aggregators such as AppAnnie or reported app network data. In some cases ‘real’ game app usage is inflated by up to 2 times due to a number of users downloading games but never playing, users playing once and never playing again, multiple device usage, inflated app network numbers. The list goes on..

The esports and streaming space fares better as viewership and engagement data is more reliable. Whether it is the number of active views and engagements on Twitch, YouTube and beyond being tracked, or the number of attendees at a tournament, the numbers are hard to fudge. The challenge here mostly involves influencer and key opinion leaders (KOL) amplification which is prone, as the wider ‘earned’ space is with claimed exposure data.

The most reliable source, while still emerging, is the in-game advertising space where there are fewer opportunities for inflation and programmatic capabilities.

In-target reach is also a hot topic as reach-based data points related to in-target exposure are hard to come by. While broader online advertising can benefit from in-target tracking and delivery like Nielsen DAR, there is currently no standardised approach that covers the gaming space and advertisers are largely in the dark as to their desired level of exposure.

Clearly however it is not just a reach play for advertisers – they want to understand the tangible ROI they can achieve through advertising and integration in this space. The good news is that brands are piling in to get a first mover advantage.

Many brands clearly see the upside such as Unilever’s haircare brand Clear which has consistently invested in their esports sponsorships. While they have Christiano Ronaldo as a brand ambassador they see their future growth coming from the future Ronaldos of esports. Other major advertisers though have been more reticent citing lack of visibility on the return it will bring to their bottom line. There are set to be more of these big brands, but we live in uncertain times and it won’t be until there are viable benchmarks and success metrics approved by recognised bodies that we see the potential reaching critical mass.

MEASUREMENT

Ok, so you have data and a firm understanding of the ecosystem, and the next step is planning activity and equating that back to brand or business outcomes. Easy? Perhaps not.

Charlie Baillie, Chief Revenue Officer and Co-founder at Ampverse has seen most activity they run in esports and gaming as ‘upper or mid funnel given the ability to authentically influence brand consideration with Gen Z and young professionals, however that does not mean to say it cannot deliver meaningful ROI’. He states that approaching this outside of a sponsorship or partnership lens and more from an always on content strategy can help drive genuinely deep engagement, with that latent affinity primed to be activated when brands need to move a consumer towards considering their brand (versus just being aware of it).

Whilst the upper and mid funnel seem more suited for the more prevalent activations in esports and gaming (such as sponsorships and partnerships); Baillie continues to observe that ‘gaming influencers have been able to drive more performance based outcomes, when the product fit is right – given their authenticity and high audience engagement’. Of course, from a referral or product affiliate perspective this sort of activity is far easier to track via links and pixels than say a physical product sponsorship – so where there is digital opportunity the lesson learned can be to instil the same rigour and operational implementation to track and measure inbound leads or sales as you would in regular digital campaigns.

The main challenge for brands in terms of measurement remains taking the trackable and data-informed digital activity approach and applying to the range of offline or hybrid platforms within esports and gaming. A partnership like giving away in-game items or currency associated with a ‘lending’ brand could indeed be a great way to drive brand affinity, but measuring that presents issues. How many players saw that offer, or how many players used it? That is slightly more answerable depending on the level of in-game or in-app analytics and data a publisher has, and is also willing to share. This also would not be consistently measured and there is also no third-party verification to this data set. How many players understood the brand offer and as a result now have a greater level of unaided awareness, consideration or purchase intent for that brand? Much, much harder to deduce even with a data set explaining conversion points, clicks, impressions and engagements.

This all comes down to standards – regulatory presence that is unbiased, consistent in the way it measures and benchmarks and is able to provide easy access to that data to all parties so they can make informed decisions about activations, but (more pertinently to the points outlined above) understand the impact of their media or messaging on business outcomes. The industry still has a way to go, but as brands adopt esports and gaming and as publishers and tech partners continue to monetise opportunities there will hopefully be an inflection point of consistent measurement practices to help keep all parties engaged and optimistic about continued exponential investments in the arena.

BRAND SAFETY

In July, over 1000 advertisers globally pulled spend from Facebook in support of the Stop Hate for Profit campaign. The major tech giants are increasingly struggling to convince advertisers that they are doing enough to fight hate speech on their platforms. This is largely being driven by consumer sentiment with a recent study by IPG Mediabrands, CHEW, BMW and Magna showing that for ads appear against negative content, consumers were 4.5 times more likely to think brands don't care about them and 3 times more likely to feel that the brand is not in the know. So while many advertisers are expected to resume social activity across the major platforms in September, there is a growing appetite for alternative channels which can provide a more brand safe offering.

Gaming and esports platforms have been touted as a viable option, in part due to the high reach potential. The SEA gaming market is expected to register a Compound Annual Growth Rate (CAGR) of 8.5% over the forecast period of 2020 to 2025. It is an area that also appeals due to it being an area where many of the problem areas associated with broader online advertising are much less of an issue.

For example:

Mobile games have to pass the stringent policies of Google and Apple app stores in order to make it onto their platforms in the first place. What nefarious activity that does occur is generally weeded out in the long run. Third-party ecosystems like Samsung also have it in their best interests to follow suit.

In-game advertising on PC and console have the benefit of direct integration with programmatic Software Development Kits to provide greater oversight and policing of ad placements. The bigger challenge for these offerings is viewability but the industry is moving quickly to learn from the pitfalls of broader online advertising here.

Esports provide an active engaged audience which spans a diverse demographic in the region. Integrations and sponsorships, when done well, provide a natural extension for a brand. This is largely a brand safe environment, the challenge comes from the risk of broader amplification.

Major streaming platforms have provided the industry with massive scale beyond the core game playing experience with (xx – waiting number) streaming games in SEA alone. But with scale comes a proliferation of platforms looking to monetize the opportunity, be it Twitch, Caffeine, Facebook Gaming or Mobcrush. Fortunately the channels only work with affiliate or partner broadcasters. The watch out here though is the fan comments, but these are for the most part moderation strictly.

There will always be instances where a brand will appear against negative or harmful content and this esports and gaming space is no different. As platforms introduce more community interaction, there will be inevitably more opportunities for this content to surface.

However, the territory has shown the green shoots of a viable alternative to other, more messy ecosystems, and has shown a genuine drive to learn from many of the mistakes of the online advertising world. Many brand safety verification providers are working to provide universal measurement and deterrent solutions with technologies borrowed from the mobile space.

Once this tracking and measurement is widespread and consistent in what it tracks, the only way is up for the industry in the short term. The long term future though will require this measurement to be integrated into meaningful effective metrics such as eCPM or effective cost per view (eCPV) which advertisers can plan and optimize against.

CONCLUSION

Esports interest and attention has surged during global lockdown restrictions as a result of COVID-19; and whilst offline events have been affected the esports arena has pivoted with greater ease than most other entertainment or sporting outlets. A case in point is the Rainbow Six Siege events that Ubisoft were due to run; and how very quickly they translated a physical tournament into weekly, cross-platform and fully open online community tournaments. The ability to change direction at pace and still maintain consumer engagement, participation and ultimately growth is impressive – and certainly that agility and digitally-native DNA of esports and gaming is irresistible to brands.

Data and benchmarks: as a currently semi-regulated space, data is an area of concern for advertisers. The size of the opportunity is often inflated and there is a real need for accurate measurement of game download and usage numbers. Advertisers are also looking for greater transparency on in-target delivery. Not all gamers are teens and often the revenue opportunity will come from demonstrating the broader appeal and engagement of the gaming environment. ROI and sales response measurement is not currently available and this will be critical to unlock the more uncertain or unadventurous advertisers, particularly in this conservative environment

Measurement: we only need look to the evolution (or more pertinently, the lack thereof) of measuring offline activations impact on ROI to contextualise some brands nervousness with entering into esports or gaming as a marketing channel. Digital activations can be tracked through standard ways, but whilst a digitally-native arena the main opportunities for brands seem to be outside of digital activity – and so brands must either help find digital opportunities that work towards their objectives or keep track of developments and help lend their view and contribute to defining a consistent way to measure impact from their offline campaigns in the space.

Brand safety: given the potential scale of eyeballs and revenue, esports and gaming platforms are notably keen to learn from the lessons learnt from the broader online advertising space. Real trust will only come once the industry can align on universal tracking and measurement that moves with the pace of change of the industry.

Of course, brands must consider the elements we have discussed to ensure they can capitalise on this opportunity with sufficient strategic, operational and compliant rigour – and if they do not, those very same opportunities could very much turn into a threat to their brand image or enhance perceptions of ineffective marketing with no clear outcome. As long as marketers are responsible, strategic and investing for the right reasons then even with perceived gaps in data, measurement and brand safety controls there could well be fertile opportunity for them to grow.